Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

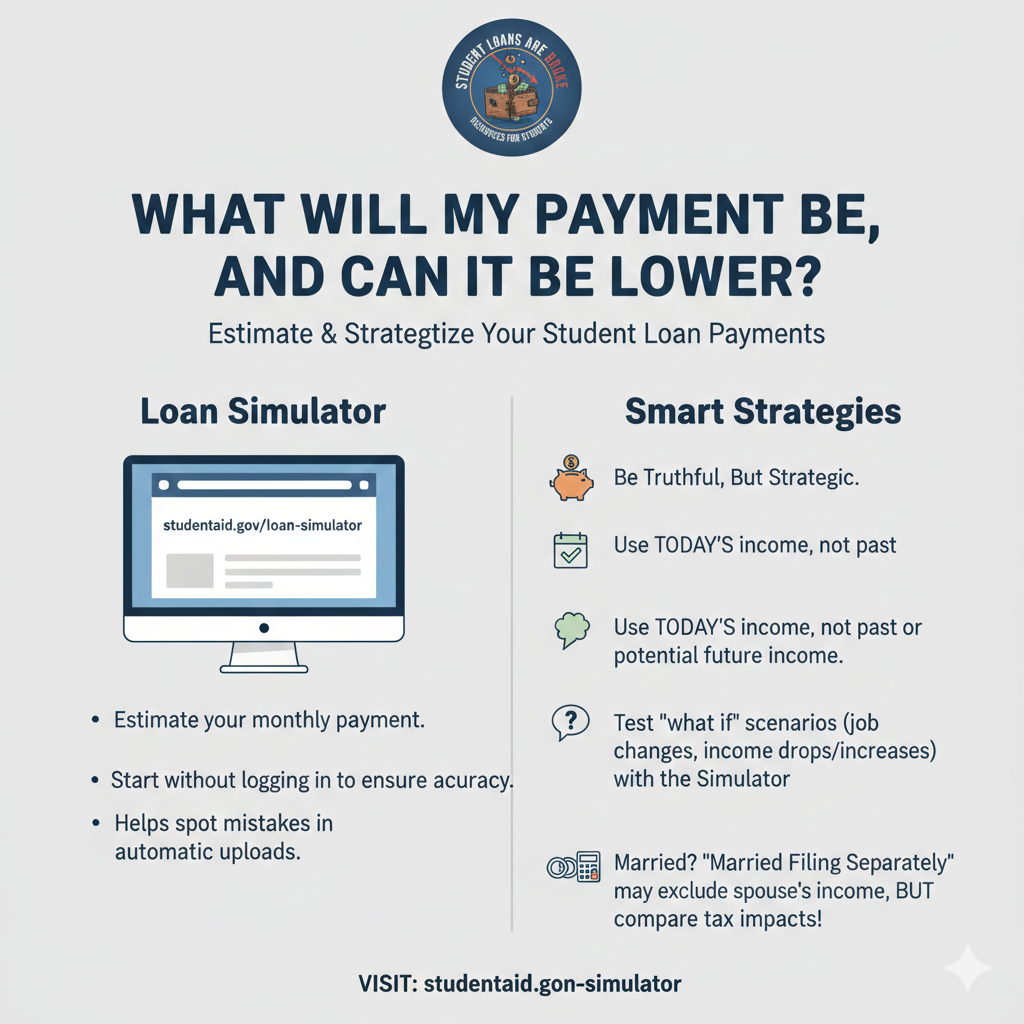

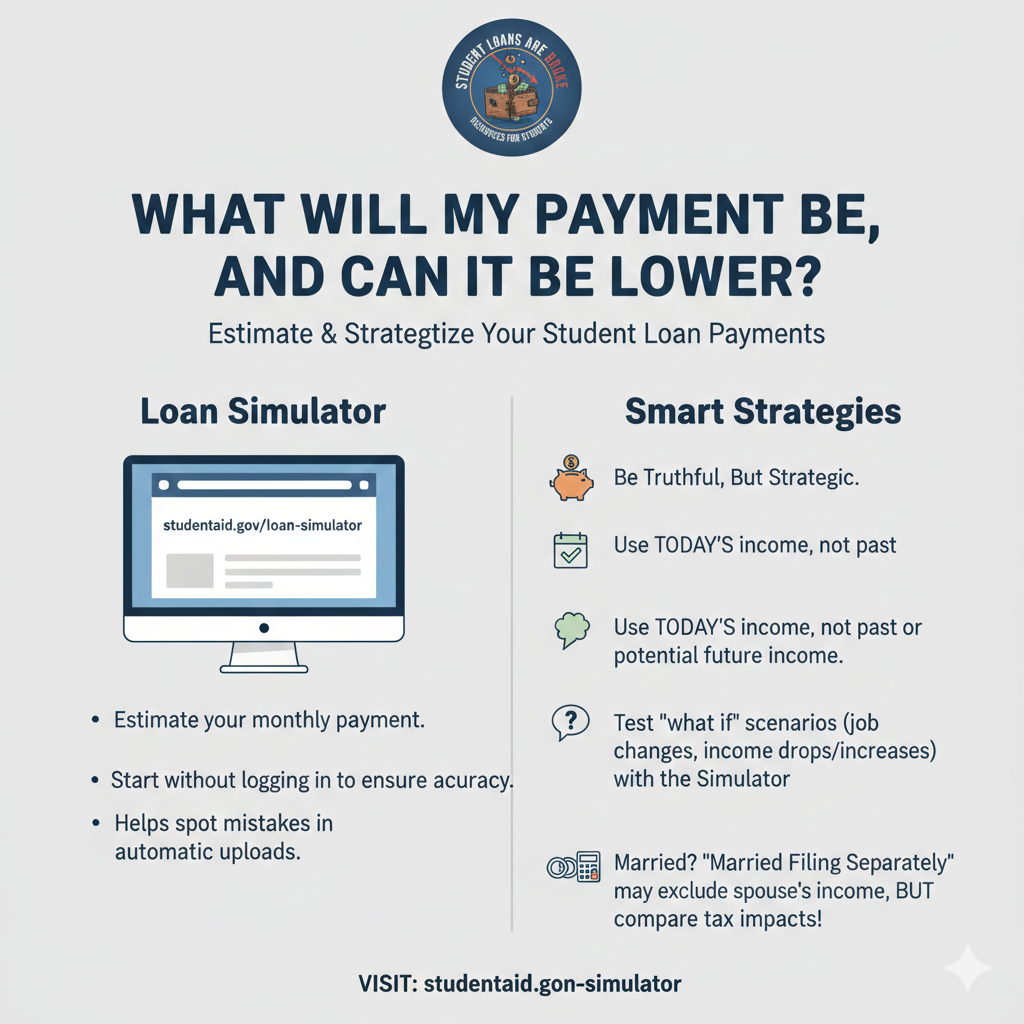

You can estimate your monthly student loan payment using the Department of Education’s Loan Simulator: studentaid.gov/loan-simulator

We recommend starting without logging in. This lets you see exactly what information you’re entering and what the system is using to calculate your payments. Automatic uploads can be convenient, but they can also bring in wrong or outdated information. Starting simple helps you spot mistakes.

Your payment is based on the income information you give your loan servicer — and you must be truthful. But you can also be smart and strategic:

The Loan Simulator is a helpful way to test different “what if” situations. You can check what your payment might look like if you change jobs, lose a job, or have a drop in income, or an increase in income!

If you’re married, you may also want to think about how you file your taxes. Your tax return is often used to show your income, and if you file jointly, your spouse’s income may be included in the calculation of your payment.

“Married Filing Separately” can likely prevent your spouse’s income from being counted. But it may also increase your taxes, so you’ll want to compare both options carefully. There isn’t one answer that works for everyone.