Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

How are Student Loan Payments considered when I apply for a Mortgage?

Every mortgage lender will determine their own policies but most mortgage lenders will follow the guidelines of the specific loan program you are applying for (conventional Fannie Mae or Freddie Mac programs, FHA, VA, etc.). If your student loan payments may be getting in the way of your mortgage approval, it might be worth taking the time to figure out which program you want to apply for and to understand the specific rules that will be used for your application.

Generally, you will need to show that you can afford your new mortgage payment as well as your required student loan payment. Now, what you can “afford” has everything to do with what your required monthly payments are divided by your monthly income. Both of those numbers can be arbitrary and not exactly fair to you the specific moment you are applying for your loan. Your debts may be calculated as too high because your loans are in deferment and the lender applies a calculation to estimate your student loan payment as much higher than it actually will ever be. Or your income may be calculated as too low because you rely heavily upon commissions or bonuses and you aren’t yet showing a two year history of that variable income on your tax returns so the lender won’t count that variable income when calculating what you can “afford.”

Generally, your required monthly student loan payment is what will be used to calculate what you can afford for your new home loan. Therefore, if you want to stretch, finding a way to have the lowest required monthly student loan payment would help you get there. Nothing stops you from paying more than required each month on your student loan but keeping your required monthly payment higher than it needs to be will stop you from qualifying for a larger mortgage.

If you’ve already applied for a mortgage loan, or if you were denied and want to look back on what monthly payment was used to analyze your mortgage application, you can look at the Uniform Residential Loan Application (form 1003) that you signed (probably electronically) when your mortgage loan application was prepared for you by your mortgage lender. If the monthly payment(s) used for your student loans was higher than what you expected, and especially if your loan was denied as a result, the information below may be useful to you.

We’ve provided below the exact language used in the mortgage lending guidelines. These guidelines are clunky. For example, in the Freddie Mac guidelines, your mortgage lender is referred to as the “Seller” because they are potentially “selling” to Freddie Mac as an investor. But we’re leaving the language alone so that you can see what your mortgage lender is seeing.

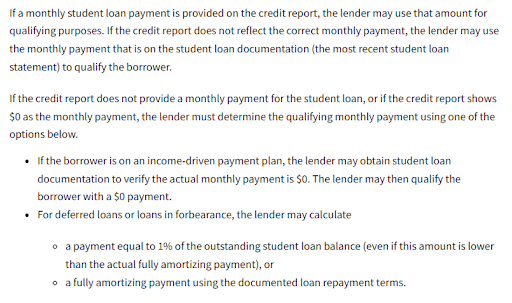

If your mortgage loan is a “conventional” loan, either the Fannie Mae or the Freddie Mac guidelines will apply:

FHA (Federal Housing Administration):

For outstanding Student Loans, regardless of the payment status, the Mortgagee [Mortgagee = the lender] must use:

• the payment amount reported on the credit report or the actual documented payment, when the payment amount is above zero; or

• 0.5 percent of the outstanding loan balance, when the monthly payment reported on the Borrower’s credit report is zero.

VA (Veteran’s Administration):

If the borrower(s) provides written evidence that the student loan debt will be deferred at least 12 months beyond the date of closing, a monthly payment does not need to be considered.

If a student loan is in repayment, or scheduled to begin within 12 months from the date of VA loan closing, the lender must consider the anticipated monthly obligation in the loan analysis and utilize the payment established by calculating each loan at a rate of five percent of the outstanding balance divided by 12 months. Example: A borrower has a $25,000 student loan balance and you multiple it by 5%, which equals $1,250. This amount ($1,250) is divided by 12 months to equal a monthly payment of $104.17.

If the payment(s) reported on the credit report for each student loan(s) is greater than the threshold payment calculation above, the lender must use the payment recorded on the credit report.

If the payment(s) reported on the credit report is less than the threshold payment calculation above, in order to count the lower payment, the loan file must contain a statement from the student loan servicer that reflects the actual loan terms and payment information for each student loan(s).

USDA (United States Department of Agriculture):

Student loans

• For outstanding student loans, regardless of the payment status, lenders must use:

o The payment amount reported on the credit report or the actual documented payment, when the payment amount is above zero; or o One half (.50) percent of the outstanding loan balance documented on the credit report or creditor verification, when the payment amount is zero.

• Student loans in the applicant’s name alone but paid by another party remain the legal responsibility of the applicant. The applicable payment must be included in the monthly debts.

• Student loans in a “forgiveness” plan/program remain the legal responsibility of the applicant until they are released of liability from the creditor. The applicable payment must be included in the monthly debts.